property tax forgiveness pa

Yes 100 percent disabled veterans receive a full property tax exemption in Pennsylvania if their annual income is less than 94279. A The Commission will review cases that have been granted real property tax relief under the PA.

Pennsylvania S Property Tax Rent Rebate Program May Help Low Income Households Legal Aid Of Southeastern Pennsylvania

It is not an automatic exemption or deduction.

. Up to 25 cash back All states have laws that allow the local government to sell a home through a tax sale process to collect delinquent taxes. The homeowner will need to pay each and every monthly or quarterly installment. Ad The Leading Online Publisher of National and State-specific Small Business Legal Docs.

VIII 2c at 2-year intervals. Pennsylvanias median income is 61124 per year so the median yearly property tax paid by Pennsylvania residents. Subtract Line 13 from 12.

07012022 Harrisburg PA Property TaxRent Rebate Program. Property tax reduction will be through a homestead or farmstead exclusion. Record tax paid to other states or countries.

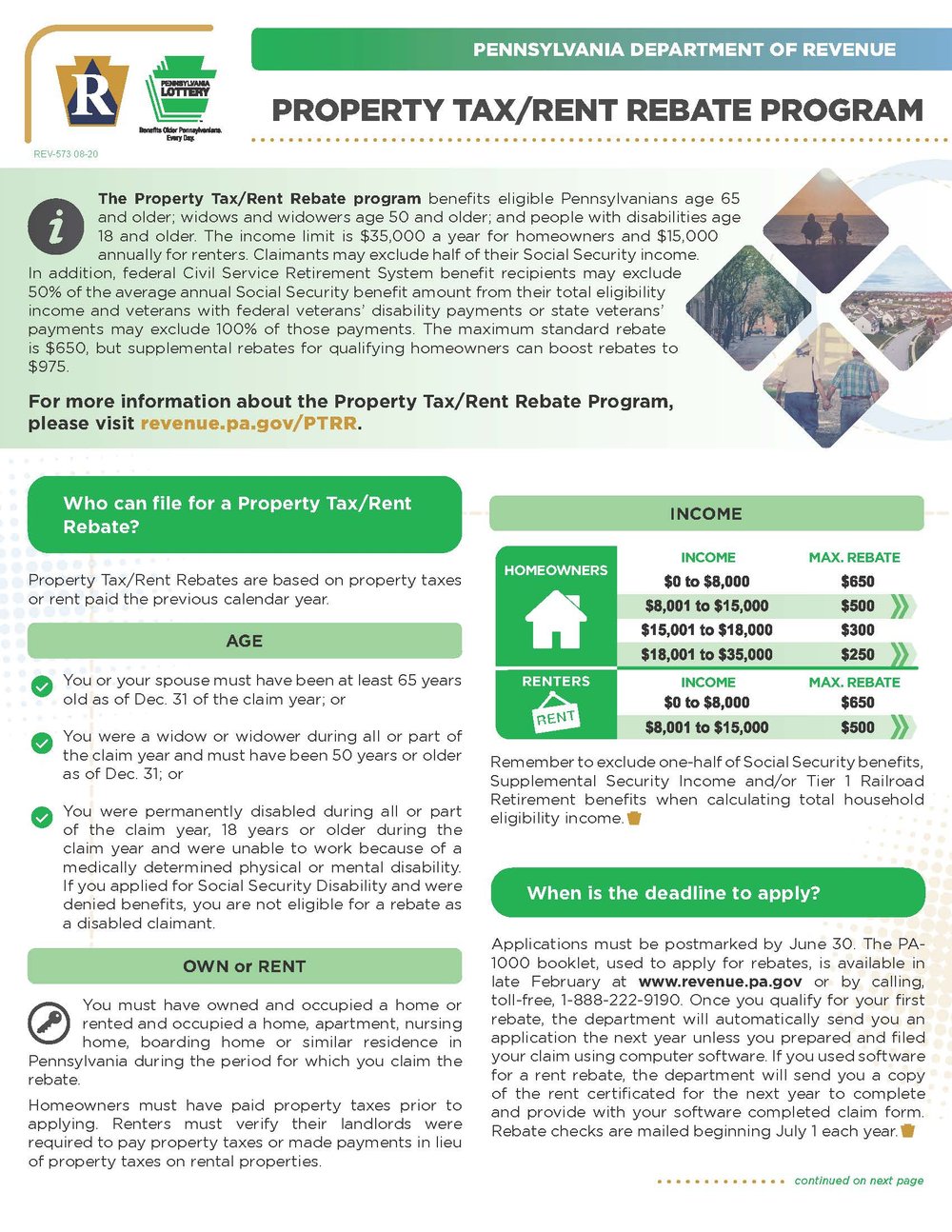

Provides a reduction in tax liability and. If none leave blank. This is a program that has delivered more than 73 billion in property tax and rent relief since the programs inception in 1971 Revenue Secretary Dan Hassell said.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Raise the personal income tax from 307 to 432 and cap the rebates for homestead properties at 2340 effectively eliminating school property taxes for more than 2 million homeowners. The rebate program also receives funding from slots gaming.

The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability. 2 Following the bills enactment the Pennsylvania Department of Revenue Pennsylvania Department released guidance explaining the provisions of Act 1 and. The median property tax in Pennsylvania is 135 of a propertys assesed fair market value as property tax per year.

B On the second anniversary of the granting of real property tax relief under the PA. Counties in Pennsylvania collect an average of 135 of a propertys assesed fair market value as property tax per year. The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006.

The Taxpayer Relief Act provides for property tax reduction allocations to be distributed by the Commonwealth to each school district. 5 2021 Pennsylvania enacted Act 1 of 2021 Act 1 specifically excluding forgiven Paycheck Protection Program PPP loans and economic impact payments 1 from personal income tax PIT. Veterans may still receive an exemption if they can prove financial need.

Forgives some taxpayers of their liabilities even if they have not. We want Pennsylvanians to know that there is still time to apply for rebates on property taxes and rent paid in 2021. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

Content updated daily for pa state tax forgiveness. Jan 25 2021 0110 PM EST. Features myPATH offers for Property TaxRent.

Then move across the line to find your eligibility income. Pennsylvanias overall state and local tax burden including income property and sales taxes equates to 97 percent of average annual income according to an analysis done by the financial news. For example 10 means you are entitled to 100 percent tax forgiveness and 20 means you are entitled to 20 percent tax forgiveness.

Ad Looking for pa state tax forgiveness. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Property Tax Penalty Forgiveness.

Below is a summary of how Pennsylvania tax sales work but tax. Eligibility income is greater because it includes many nontaxable forms of income such as interest on savings bonds alimony the nontaxable gain on the sale of a home insurance proceeds inheritances winnings from the PA Lottery foster care payments and the value of gifts from people living outside the. At the bottom of each column is an amount expressed as a decimal which represents the percentage of tax forgiveness you are allowed.

To claim this credit it is necessary that a taxpayer file a PA-40 return and complete Schedule SP. The applicant will need to be the owner of the real estate property according to the assessors records. Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability.

If Line 13 is. This is the first time in the history of the program that an electronic filing option is available for the Pennsylvanians who benefit from this program. Property TaxRent Rebate Program claimants now have the option to submit program applications online with the Department of Revenues myPATH system.

Waiver of interest surcharges and penalties on outstanding real and personal property tax debts with the. It is designed to help individuals with a low income who didnt withhold taxes throughout the year and those who are retired. Being a homeowner in Pennsylvania can qualify you for another property tax relief programthe state property tax reduction allocation.

In Part D calculate the amount of your Tax Forgiveness. On 1 March 2021 during the Fiscal Strategy Debate the Most Honourable Dr. Since the programs 1971 inception older and disabled adults have received more than 73 billion in property tax and rent relief.

Cut school property taxes by 644 billion through an increase in the personal income tax from 307 to 462. Ra-retxpagov Please do not send completed applications or personally identifiable. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability.

Of course the homeowner must have been delinquent on paying their property taxes and it usually needs to be a recent issue and hardship that the person is facing. The penalty for real estate taxes was forgiven through November 30 2020. The County Board for the Assessment and Revision of Taxes will grant the tax exemption.

Accordingly failing to pay your real property taxes in Pennsylvania could lead to an upset tax sale or a judicial tax sale and the loss of your property. Tax amount varies by county. Further to qualify for the credit it is necessary to calculate both the taxable and nontaxable income.

Pennsylvania is ranked number sixteen out of the fifty states in order of the average amount of property taxes collected. Record the your PA tax liability from Line 12 of your PA-40. Taxes paid in December will now be assessed the penalty amount and those taxes must be paid by December 31 2020.

Eligibility income for Tax Forgiveness is different from taxable income. It is a PA-funded homestead exclusion that lowers taxable values across the state but the exact amounts are set by counties. Ad Apply For Tax Forgiveness and get help through the process.

Tax relief can be a big help because it can reduce or even completely negate the taxes you owe. Cases that have been granted tax exemption will be reviewed every 5 years to determine continued need for exemption from certain real estate property taxes. This section cited in 43 Pa.

Hubert Minnis Prime Minister Minister of Finance announced the Governments immediate implementation of the Real Property Tax Forgiveness Program the Program as outlined in The Real Property Tax Amnesty Order 2021 the Order and which came into effect on 1. Code 524 relating to processing applications. WTAJ Older Pennsylvanians and Pennsylvanians that have disabilities are now eligible to apply for rebates on their property taxes or.

About The Taxpayer Relief Act. The Property TaxRent Rebate Program is one of five programs supported by the Pennsylvania Lottery.

Taxes Property Tax Rent Rebate Program

What Is A Homestead Exemption And How Does It Work Lendingtree

Pennsylvanians Can Now File Property Tax Rent Rebate Program Applications Online Pennsylvania Legal Aid Network

/cloudfront-us-east-1.images.arcpublishing.com/pmn/AOSJXQVTCVHSPMOI75C4M4MFM4.jpg)

How To Reduce Your Property Tax Bill In Philadelphia

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

City Council To Consider Competing Tax Relief Measures Whyy

Property Tax Homestead Exemptions Itep

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Extend Mortgage Cancellation Tax Relief Real Estate Agent And Sales In Pa Mortgage Debt Mortgage Rates Today Mortgage Loan Originator

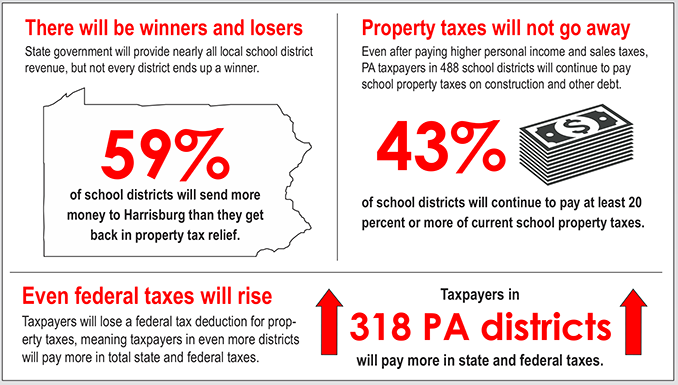

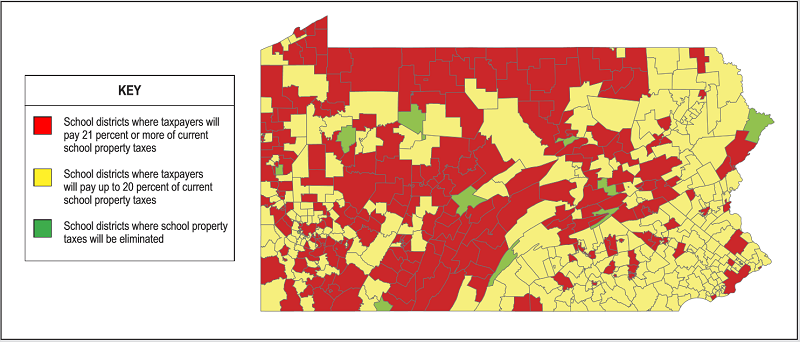

Property Tax Bill Will Cost Pa Taxpayers More

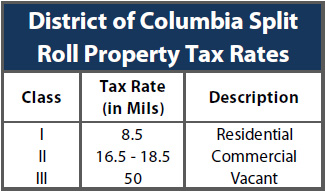

Split Roll Property Taxes Itep

Pennsylvania Homestead Tax Relief The Commonwealth Of Pennsylvania S State Government Enacted Bullying Laws School Bullying Masters In Business Administration

Pennsylvania S Property Tax Rent Rebate Program May Help Low Income Households Legal Aid Of Southeastern Pennsylvania

Property Tax Rebate Program For 21 22 Perkiomen Valley School District

Pennsylvania S Property Tax Rent Rebate Program May Help Low Income Households Legal Aid Of Southeastern Pennsylvania

.jpg)